Destroying casuals incomes

The Albanese governments attack against casuals is Statutory Wage Theft.

This is the fourth in my series explaining the Albanese government’s ‘Loophole’ industrial relations Bill currently before parliament. The first three Substack posts are: Overview (2 October 2023) then Neutering High Court on contract law (6 October 2023) and Outlawing self-employed and gig (13 October 2023)

I often feel that these sorts of posts can be a bit dry and uninteresting. But the reality is that we’re dealing with issues that cut to core legal structures and institutions that determine how we are allowed to live in society. So I plough on! What I’m explaining in these posts is the content of the representations I’m making to the seven independents in the Senate in asking them to vote against the Bill.

This post looks at what the Bill does to casual employees—that’s 20 percent of the workforce or around 2.7 million people. Staggeringly, this Bill is a direct attack against the incomes of these people. This post explains how this occurs by giving the facts about the maths.

But first a quick (but very relevant) side-issue. You’ll be aware that the government is also moving with its Misinformation/Disinformation Bill. This is a law to control the free expression of opinions, limiting expression to what ‘government’ says is ‘true’. I provided some analysis of this in my Self-Employed Australia commentary Einstein is Dangerously wrong. Silence him with a new law! (28 July 2023)

Returning to the Loophole Bill: this is a piece of proposed legislation about which the government itself is engaged in blatant misinformation, disinformation, and straight-out lies. The government is saying that the Bill ‘closes loopholes.’ This is false. In fact, the Bill is a massive agenda to transform contract law, the very basis upon which our economy operates and ‘we’, the people, earn our incomes and choose to spend our money. This is proven by looking at the actual wording of the Bill as I’ve done in my second and third posts (links above). This is the ‘high-end’ agenda with several sub-agendas embedded underneath it.

One key sub-agenda is the casuals issue. The facts show that the Bill will result in major income reductions for almost all casual employees. Now to explain that claim with the facts.

Overview

The Bill redefines casual employment so narrowly and applies such huge penalties for getting it wrong that businesses will be forced to make the bulk of current casuals full- or part-time employees. The result is a statutory form of ‘wage theft’.

This is because casual employees earn around 6 percent more than full- or part-time employees. With businesses being (effectively) forced to have only full- or part-time employees, the loss of income for any person who would prefer to be a casual employee:

If on the minimum rate of pay of $23.23 an hour, could be up to $3,063 per year.

If on the average pay rate of $40.65 an hour, could be up to $5,355 per year.

That is, the Albanese government’s (planned) statute outlaws most casual employment, resulting in lower wages for those employees. Hence the term ‘Statutory Wage Theft.’

I won’t overload you in this post with the technical wording of these sections of the Bill, but you can find that wording here in SEA’s submission to the Senate independents asking them to reject these sections of the Bill (15A and 359A).

The financial advantage of being a Casual rather than Full- or Part-time employee

It is often claimed (mostly by unions) that casual employees do not receive holidays. Most people, it seems, hear this message and assume that casuals are disadvantaged. Certainly, that’s the impression that unions’ public relations spin seeks to achieve.

But this is clearly misinformation. This is because casuals receive their holiday pay in small ‘bits’ instead of accumulated lump sums. I was recently in discussions with a very senior and experienced industrial lawyer and I was surprised that this lawyer was surprised when I said that casuals earn more than full/part-time employees. I asked around. And even several experienced business people I chatted to, were also not aware. I think it’s just an issue that people have not turned their minds to!

So let me step you through the facts of how this works.

A full/part-time employee has income taken away from them and held by the employer. The withheld money is only paid to the employee when the full/part-time employee actually takes holidays.

A casual employee is paid a total amount (on an hourly basis) that includes an allowance for holidays plus additional amounts. In all, it can be calculated that a casual employee is around 6 percent better off financially than a full/part-time employee doing the same work.

The calculations work something like this:

The number of days in a year 365

Subtract weekend days in a year 104

The potential days available to work 261

Full/part-time ‘entitlements

A full-time employee has ‘entitlements’ (in truth, withheld money) which can be expressed as a percentage of days available to work (i.e., 261 days)

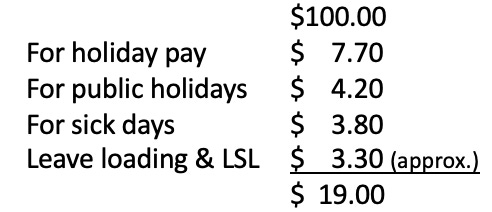

This calculation is at the high end, as many full/part-time employees don’t stay with their employer long enough to qualify for all ‘entitlements.’ For a simple example of how this works, take a full-time person who has earned $100. The employer has withheld amounts of money as follows:

The full-time employee has really earned $119.00

But, that $19.00 is only paid to the full-time employee when the employee takes holidays or is sick, and so on. That is, ‘entitlements’ are really money withheld from the employee.

Casuals receive more

Now look at casual pay rates. Casual employees receive (almost always) 25 per cent extra.

That is, taking the $100 example above, a casual receives $125.00. In other words, the casual receives $6 more ($125 minus $119) than the full/part-time employee, but no money is withheld from the casual employee.

This incredibly simple fact shows that the claim that casuals do not receive holiday pay is misinformation because the claim is a contortion of the facts. Casuals receive their ‘holiday pay’ in their hourly rate. And casuals receive even more, 6 percent more, because of their 25 percent ‘loading.’ In addition, it is usual for casuals’ superannuation to be based on their higher income and they therefore receive more superannuation.

I’ve prepared a table that shows the extra money that a casual could receive when compared with a full/part-time employee. These are maximums. Actual differences will depend on each individual situation.

That is, a casual employee on the

Minimum pay rate is up to $2,766 per year better off than being a full-timer - And up to $3,063 better off after superannuation.

And a casual employee on the

Average wage is up to $4,821 per year better off than being a full-timer - And up to $5,355 better off after superannuation.

Frankly, these are pretty powerful facts.

How the Loophole Bill will almost certainly eliminate casual employment

The Bill (Section 15A) applies a new definition of casual employment and significant fines are introduced (Section 359A) for employing a casual who does not strictly meet the definitions. On any assessment, the definitions are so convoluted, complex and subjective as to be indecipherable by the ordinary business person and possibly even by competent lawyers.

Further, there are fines of up to $93,900 for employing a ‘casual’ in a way that does not fit the definitions. Presumably, a fine would apply per breach per employee. And these fines would apply retrospectively. That is, if a business employed a ‘casual’ who was subsequently found not to be a casual, the business would be fined heavily.

An analysis of the new definitions in conjunction with the fines leads to a conclusion that few business people, particularly small business people, could or would take the risk of employing anyone as a casual.

There are 2.7 million casuals in Australia (Aug 2022). I would anticipate that the considerable bulk of existing employees would need to be transferred to full-time employment, or more likely, part-time employee status. The consequence of this is that all of these people denied casual employment will be transferred to a lower wage/income than if they had remained as casuals.

The 2.7 million is around 20 percent of the workforce. My best guess is that the definitions in the Bill will reduce the percentage of casuals to (certainly) under 1 percent of the workforce at least. Again, for the details of the legislative wording and analysis, please see SEA’s submission to the Senate independents.

More on ‘Statutory Wage Theft’

To expand on the discussion above, one of the very strange aspects about the debate over casual employment of the last decade-or-so is the near-total absence of recognition that casual employees earn more, quite a bit more, than full- and part-time employees. It is even stranger that the question is not raised as to why would businesses employ casuals when it costs them more? Surely simple ‘cost accountant maths’ would indicate that no business would employ casuals?

The answer is quite simple. Business people must respond to shifts in the demands and desires of their customers, whether the customers are other businesses or consumers. Those shifts in demand are never-ending. In order to respond, it’s necessary that the business’s workforce and management arrangements are both dynamic and flexible. Casual employment is an important part of that dynamic mix.

Through its proposed Loophole Bill the Albanese government rejects the reality of how business people must operate and how the economy operates. The government effectively asserts that it knows more about running an organisation from a distance than do the people themselves who actually run them.

What is strangest of all is that in a time where ‘wage theft’ is a major issue which (deservedly) attracts much attention, this issue in the Loophole Bill is not being recognised for what it is.

This is why the label ‘Statutory Wage Theft’ is accurate.